Predicting using Monte Carlo Simulation

The world is a paradox of sorts, both ordered and predictable. It is ruled by a predetermined distribution of outcomes with clear probabilities, and it is equally chaotic, where a single chance encounter can impact every future event in the timeline. The anecdotal “missing your bus only to meet the love of your life which instantly changes what had otherwise been a certain timeline set in stone since not only your birth, but your parents –and their parent’s—birth” is proof of this (at least in our social narrative). In theoretical physics and philosophy we colloquially know this as the “Butterfly Effect,” a thought experiment attributed to the work of Edward Lorenz. (Lorenz, 1963) Global weather events, such as a tornado in Kansas, could be influenced by the flapping of a butterfly’s wings weeks prior.

Indeterminacy in Determinate Systems

In data science we are concerned with all kinds of complex systems, both open and closed. In Lorenz’s work we are specifically looking at hydrodynamic systems (closed fluid systems subject to the law’s of physics, such as the conservation of energy) where (intuitively) changes in pressure in one part will result in equal and opposing changes in other parts such that the system maintains an equilibrium.(Lorenz, 1963) Lorenz shows however that these systems such as the weather are reduced to three differential equations which are ultimately non-deterministic/unstable.(Lorenz, 1963, p. 141) Radical changes in systems (such as the formation of a tornado or tsunamis) can result quickly from changes magnitudes in order smaller (e.g., the flapping of a butterfly’s wings or the movement of a tiny fishing boat). Lorenz concludes that this questions the stability of any long-term weather models; if a cluster of local systems are stable and similar, perhaps reliable short-term prediction is possible, but as the variance is increased our ability to make long term predictions decreases.(Lorenz, 1963, p. 141)

Rounding Errors and Limitations of Regression

Data scientists are not unlike meteorologists and other scientists. We too rely on mathematical models to make accurate predictions, and instability, even randomness, in those models compound. Even miniscule “rounding errors” can compound within a large organization. For instance, in the 1980’s a stock on the Vancouver Stock Exchange mistakenly lost 50% of its value in two years due to the stock being rounded down daily and unnoticeably using what we refer to as floor rounding. (Varshney, 2019) Like thermodynamic systems (or even more so) our equations are often not stable, or they are based on regression models which are based on the value we expect the points as a whole will regress or approximate to over time, but not necessarily at any single point in time.

Indeterminacy and Free Will

Unlike the natural sciences, in business and civics the systems we study are based on human action and decision. If you grant we are non-deterministic beings, if not with complete free-will at least random inclinations, our systems are subject to randomness which must be factored into our equations. Like the Butterfly Effect, although we have systems that we feel are essentially predictable, they are also essentially chaotic and the random actions of a single individual (say a Board Member’s off-handed media comment or an analyst’s shaky pinky finger) can have profound and unpredictable impacts on an otherwise predictable system.

What is Monte Carlo Simulation?

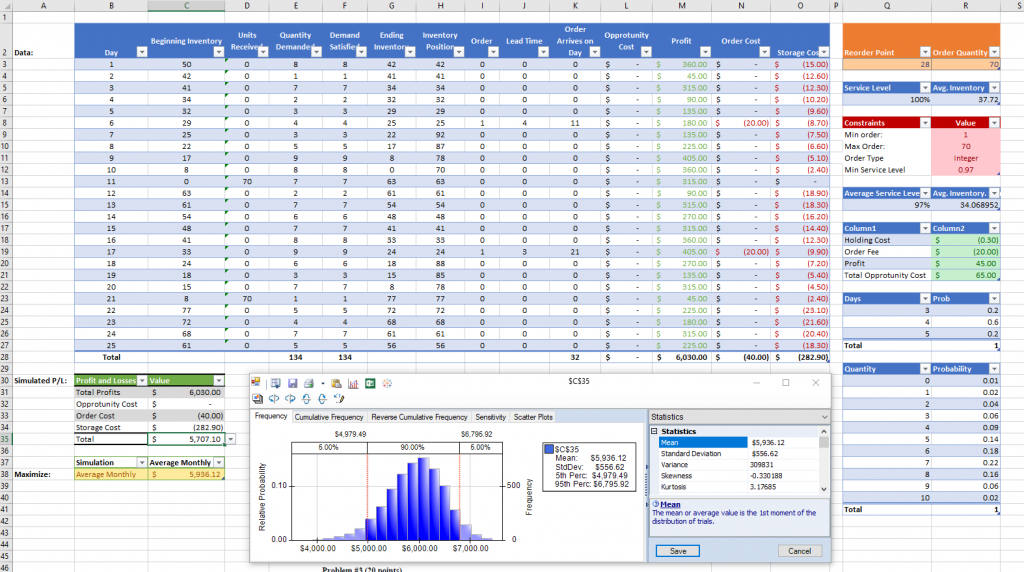

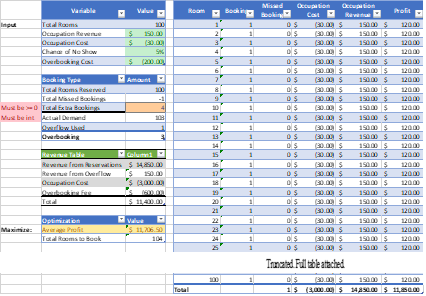

Like meteorologists we have one method to help predict the actions of large (and even not-so-large) systems—the Monte Carlo Simulation. Developed in 1940 by Stanislaw Ulam, the Monte Carlo Simulation technique allows us to predict systems of equations whose outcomes are of a known distribution by running multiple simulations of the system. Monte Carlo Simulators were initially used to predict radiation levels. (Heffernan, 2013) To account for the inherent chaos random number generators are used along with probability distributions to simulate one real possible outcome. These simulations are then run n-times based on the needs of the experimenter—computational power is the only limit to the number of simulations which can comprise a Monte Carlo Simulation—the average of these outcomes representing the expected real world outcome or mathematical solution. The advantage of Monte Carlo Simulation is that it allows the experimenter to arrive at a prediction which necessarily is based on equations which are indeterminate or subject to randomness, either because of rounding error of irrational numbers (such as π) or because of random forces (such as human free-will).

What are some ways we can use Monte Carlo Simulation in business?

There are many useful and practical applications of Monte Carlo Simulation in business, education, civics, healthcare, and any area where humans interact (even in self-driving vehicles where human randomness has effects on probability).

Project Management: Using Monte Carlo to calculate reserves

Monte Carlo Simulation is used as a technique for performing project cost analysis, reserve analysis, and risk management.(Project Management Institute, 2013) In project reserve analysis a project manager must established the balances needed for the various reserves, such as the contingency reserves and management reserves. Monte Carlo Analysis is one way in which the value of the reserves is calculated based on different project outcomes which can occur based on schedule, cost variance, human resource levels, etc. (Project Management Institute, 2013, p. 171) In project cost analysis and risk management activities Monte Carlo Analysis computes the impact of various risks and variables which have an impact on project cost and risk management preparation. (Project Management Institute, 2013, p. 340)

- Prediction of Employee Performance/Outcome. In human resources predictions need to be made to successfully manage the needs of staff, employees, and contractors. Events such as injuries and leave of absences can have material impact on the operations of a business and should be planned for in advance to ensure that adequate reserves are maintained. Employee attendance has a wide impact on performance and operational efficiency, and Monte Carlo Simulation can be used to plan workforce staffing levels.

- Disaster Preparation and First Responder Mobilization. Monte Carlo Simulation can be used to inform medical, police, fire, and other first responders about the resources they may need during different kinds of disasters, allowing them to train these resources in advance. For instance, during Hurricane Katrina Monte Carlo Simulation was used to inform the staffing of resource call centers. (Heffernan, 2013) According to Heffernan, “Critical data points, such as timing of calls, duration of calls and number of deaths were used to predict potential call load. As new data became available, the schedule was adjusted to anticipate necessary schedule changes.” (Heffernan, 2013)

- Pandemics and other Disaster Simulation. Natural disasters and epidemics can result in a large variance of possible outcomes which make it difficult for risk managers to account for, especially given their limited budgets. Knowing the best way to spend donations and tax money in advance of these unpredictable events can be made easier by Monte Carlo Simulation. In 2008 the New York City Hospitals ran Monte Carlo simulations to identify the load placed on New York hospitals, including both staff and materials. For instance, the study determined that over a 25% probability of a shortage existed, a 10% probability that the system would be short at least 46 nurses, and a 1% chance of a shortage of more than 100 nurses. (Heffernan, 2013)

Monte Carlo Simulation is an important tool used to factor in unknown variables and random events which can compound, giving scientists the ability to make better long term predictions when traditional models are inapplicable. When indeterminable probabilities of events, such as natural disasters or thermodynamic systems, or human randomness need to be calculated into our predictions Monte Carlo Analysis is a useful tool. Although the butterfly effect is often undetectable given the difference in the magnitude of forces between cause and effect, Monte Carlo Analysis can be used to help account for the apparent randomness of these events, giving us the ability to make long term predictions.

Works Cited

Heffernan, R. (2013). Monte Carlo Simulation and Human Risk. Risk Management Magazine. http://www.rmmagazine.com/2013/03/04/monte-carlo-simulation-and-human-risk/

Lorenz, E. N. (1963). Deterministic Nonperiodic Flow. Journal of the Atmospheric Sciences, 20(2), 130-141. https://doi.org/10.1175/1520-0469(1963)020<0130:dnf>2.0.co;2

Project Management Institute. (2013). A guide to the project management body of knowledge (PMBOK Guide) (Fifth Edition ed.). Project Management Institute.

Varshney, L. (2019). The Deadly Consequences of Rounding Errors. Slate. Retrieved 2021-03-06 from https://slate.com/technology/2019/10/round-floor-software-errors-stock-market-battlefield.html

Andrew is a General Partner at Northwestern Analytics and is the managing partner responsible for Business Operations and Project Management. Andrew holds his Project Management Professional certification and also serves as the Chief of Staff of Business Outreach for the Project Management Institute Chicagoland Chapter.

I think this is one of the most vital information for me.

And i am glad reading your article. But should remark on few general things,

The site style is wonderful,

the articles is really great

: D. Good job, cheers